Insights

PLI Scheme: A boost to green tech & emerging investment in evolutionary thinking

October 7, 2021The Production Linked Incentive (‘PLI’) scheme for the automobile industry and the drone industry has been introduced by the Indian Government in September 2021. The PLI Scheme aims to augment the manufacturing and development of electric vehicles and other advanced technology components. This PLI Scheme is part of the overall announcement of PLI Schemes for 13 sectors, made earlier during the Union Budget 2021-22, with an outlay of INR 1.97 lakh Crore.

Under the revised version of the much-awaited scheme, incentives have been limited to Battery Electric Vehicles (‘BEV’) and Hydrogen Fuel Cell Vehicles (‘HFCV’) in the automobile industry, as opposed to the original scheme which proposed to cover all kinds of automobiles and components. This policy decision, which is primarily centered on pushing for green technology in the automotive industry, is in line with India’s commitments under international agreements pertaining to climate change; such as the Paris Agreement, the Rio Declaration on Environment and Development, and the UN Framework Convention on Climate Change.

Read More+

The PLI scheme will have a financial outlay of INR 26,000 Crore which is expended to be disbursed over the next five years and will be become effective from the year 2022. Out of the said total financial outlay, an amount equal to INR 120 Crore has also been set aside for the manufacturing of drones.

The approved plan in the auto sector is further categorized into two schemes to provide incentives, which are the ‘Champion OEM Incentive scheme’ for Original Equipment Manufacturers (‘OEMs’), involved in manufacturing of BEV and HFCV; and the ‘Component Champion Incentive scheme’ for modern, state of the art automotive technology components used in vehicles, 2-wheelers, 3-wheelers, passenger vehicles, commercial vehicles, tractors etc.

The use of drones and advanced drone technology is slowly gaining ground in many industries today worldwide. From their use in oil and mineral rights exploration to proposals for use in commercial delivery platforms and even in gig economy ventures like photography and hand-held cinema direction, drones are now being seen as the go-to device to enable a technological evolution in the target sector. India is still not a manufacturing hub for commercial use drones and most machines in use today are complete build imports. To position itself in this emerging market, the PLI Scheme for Drones targets to bring fresh investments of over INR 5,000 Crore in three years, and further proposes incremental production targets amounting to over INR 1,500 Crore year on year.

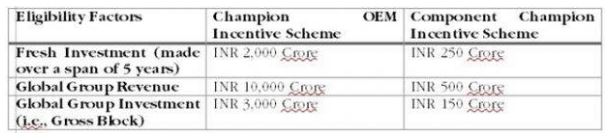

In order to avail incentives under the scheme, notified eligibility factors will be considered. This includes but is not limited to global group revenue, global group investment, global net worth and any recent major investments in the sector. In the context of the automobile sector, the scheme is open to both, existing players, as well as non-automotive industry players.

The eligibility criteria under the PLI Scheme is as below:

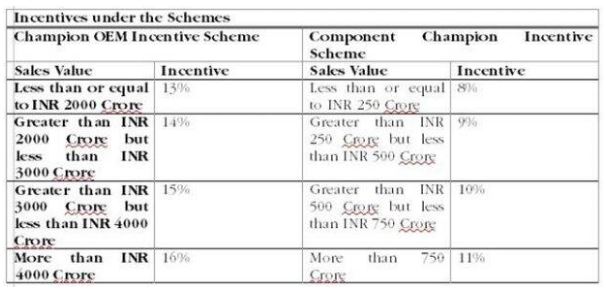

The benefits under the scheme are in the form of percentage-based incentives derived on the basis of incremental turnover considering 2019-2020 as the base year.

An additional 2% incentive is also available if the cumulative incremental turnover over 5 years is INR 10,000 Crore or more in the case of Champion OEM Incentive Scheme and if this turnover is INR 1250 Crore or more in the case of Component Champion Incentive Scheme.

Further, in addition to the incentives listed above, an additional 5% incentive is proposed for component manufacturers of BEVs and HFCVs. It has also been proposed that the benefits under the above two schemes may be bundled with the incentives provided under Faster Adaption and Manufacturing of Hybrid and Electric Vehicles (‘FAME’) scheme (which is already implemented), PLI scheme for Advanced Chemistry Cell and other sectoral State government incentives. It follows thereof that a strategic combination leverage, incorporating the benefits under the aforesaid policies and schemes, can help investing companies to claw back a significant portion of their initial investment revenue in this sector.

The thrust under the aforementioned PLI scheme is on advanced and ecologically sound automotive technology, a sector which is still in the nascent and evolving stage in India. It is important to note that the PLI scheme has left out the petrol and diesel-based vehicle manufacturers i.e., the Internal Combustion Engine (‘ICE’) vehicle industry from its scope as also other cleaner fuel-based vehicles such as those using CNG and LPG. This effectively means that the scheme does not cover 80 – 90 % of the current automobile industry in India.

The scheme in this form holds specific relevance and particular investment potential to the players that form the evolutionary electric vehicle segment of the global auto industry, ones who are engaged in driving the evolution of clean technology and sustainable auto products. Given that India today sits on the cusp of introduction of some of these major electrical auto heavyweights like Tesla and Daimler (in the passenger vehicle segment), Nikola Motors and Volvo (in the heavy vehicle segment) etc., the potential for investment in the country is now enormous and will be watched keenly by this sector of the industry to reap strategic benefits.

On the concluding note, the PLI scheme in its approved form, demonstrates the government’s intention to adopt clean and green mobility, reduce carbon emissions, and lessen India’s reliance on petroleum and related products. Besides encouraging the adoption of green technology in the automobile industry, the scheme is expected to generate 7.5 lakh jobs, INR 10,851 crore in tax revenue and to raise INR 42,500 crore worth of investments. However, given the known bottlenecks in the country for investments, this intention has to be translated to actual resolve and a true facilitation of the ease of doing business mantra for global investors. Only then will such ambitious schemes attract the full potential of global investors and achieve its proposed endeavor.

This article was originally published in Financial Express on 7 October 2021 Co-written by: Rajat Bose, Partner, Neeladri Chakrabarti, Consultant and Oshank Mittal, Associate. Click here for original article

Read Less-

Contributed by: Rajat Bose, Partner, Neeladri Chakrabarti, Consultant and Oshank Mittal, Associate

Disclaimer

This is intended for general information purposes only. The views and opinions expressed in this article are those of the author/authors and does not necessarily reflect the views of the firm.