Insights

Decoding union budget 2024

July 24, 2024As the Hon’ble Finance Minister rose to present Union Budget for fiscal year 2024-25, she underscored the strong economic fundamentals of Indian economy in terms of steady economic growth, stable inflation and fiscal consolidation, in the midst of a slowing global economy, more particularly in the wake of current geopolitical uncertainties. With this the FM outlined a detailed roadmap for pursuit of the vision of ‘Viksit Bharat’, with focus on areas such as agriculture, manufacturing, energy, infrastructure and employment.

On the direct tax front, the Finance Bill 2024 (“Finance Bill”) tabled today in the parliament witnessed a slew of proposals that are premised on rationalising and simplifying taxes, widening of tax base, providing tax certainty, easing tax administration and reducing tax litigation.

One of the most important announcements made today was to undertake a complete review of the existing Income-tax Act, 1961 within the next 6 months, in order to make it more concise, lucid and comprehensible.

Read More+

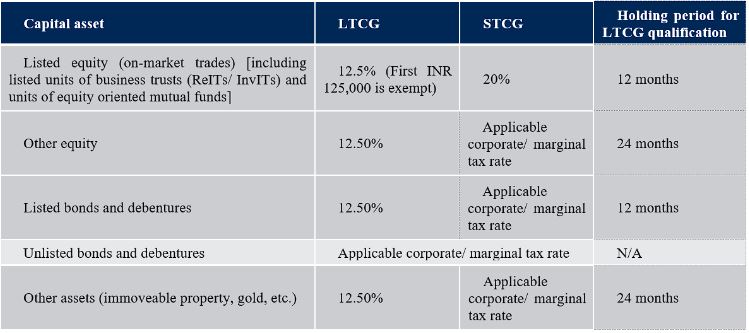

Another significant proposal came in the form of (much anticipated) capital gains simplification and rationalization. There are 3 elements in this proposal – first deals with introduction of only 2 holding periods, i.e. 12 months and 24 months for determining whether the capital gains is long term or short term; second deals with rationalization of tax rates (discussed in the table below), and third deals with withdrawal of ‘indexation benefit’ on long term capital gains as a trade-off for lower long term capital gains tax rate of 12.5%. The proposed capital gains regime, once enacted, will play out as follows:

On personal taxation front, marginal tax rates applicable to individuals, HUFs etc. have been proposed to be further reduced for income falling within the bracket of INR 3 lakhs to INR 10 lakhs to incentivize adoption of new tax regime; and the thresholds for standard deduction from salaries and family pension is proposed to be increased to INR 75,000 and INR 25,000 respectively.

On the corporate tax front, three proposals are noteworthy:

First, the buy-back tax on domestic companies has been proposed to be abolished and instead a dual regime is proposed. Effective 1st October 2024, proceeds from buy-backs are proposed to be taxed as dividends in the hands of the shareholders without any deductions. Further, the original purchase cost of the repurchased shares will be considered a capital loss in the hands of the shareholder, which can be utilized to offset any capital gains tax liabilities in the future.

Second, with a view to incentivise entrepreneurship and inbound flight of capital, the angel tax has been proposed to be abolished with effect from assessment year 2025-26, which is seen as a big relief to the companies.

Third, the Finance Bill also proposes statutory changes to carve out ‘corporate gifts’ from the purview of ‘gifts’ which are exempt from levy of capital gains tax, thus seeking to address ambiguities around taxability of corporate gifts.

In the realm of international tax, the corporate tax rate applicable to foreign companies is proposed to be reduced from 40% to 35%, which is a welcome move. Further, in a reprieve for the non-resident e-commerce operators, the 2% equalization levy (“EL”) on a non-resident e-commerce operator in respect of consideration from online supply of goods and/or services through its e-commerce platform is proposed to be withdrawn with effect from 1st August 2024. This proposal will witness only partial withdrawal of EL, as 6% EL on consideration from specified services (such as online advertisement services) will continue to remain in force.

In order to ease tax administration and reduce tax litigation, the Bill also proposes the following:

- A new amnesty scheme, namely, Vivad se Vishwas Scheme of 2024 will be notified in due course, which will help in settlement of pending tax disputes. Notably, a similar amnesty scheme was introduced in the Year 2020, which proved to be a win-win for both taxpayers and government, as it settled tax disputes for the taxpayers (without the risk of penalty and prosecution) and secured substantial revenues for the government.

- The re-assessment regime has been further proposed to be tweaked to reduce the limitation period for reassessment from the existing 10 years to 5 years from the end of the relevant Assessment Year, in cases where income escaping tax exceeds INR 50 lacs.

- The monetary limits for filing appeals by the Revenue before the tax tribunal, High Court and Supreme Court is proposed to be revised to Rs.60 lacs, Rs. 2 crores and Rs.5 crores, respectively.

- The concept of block assessment has been re-introduced in search cases. For any search initiated after 1st September 2024, the Finance Bill proposes one consolidated assessment in respect of the block period of 7 years (i.e. year of search and preceding 6 years) with the proposed tax rate @ 60% for the block period and proposed penalty @ 50% of the tax payable on undisclosed income. an article evaluating key direct tax proposals in the Finance Bill 2024.

Overall, the Finance Bill is well-balanced and highlights government’s commitment in providing stability and certainty in tax policies. For tax professionals as well as taxpayers, the announcement of comprehensive review of income tax law in near future stands out. Abolition of angel tax and EL regimes, and rationalization of buy-back tax regime augurs well for corporates. However, there have also been a few misses; contrary to expectations that concessional corporate tax rate of 15% for manufacturing companies would be revived, there was no such relief provided. Also, it was widely anticipated that some announcements on the lines of implementing the OECD’s global minimum taxation (Pillar Two) rules would be made in the Budget/Finance Bill, which have remained elusive.

This article was originally published in Bar & Bench on 24 July 2024 Written by: Rahul Yadav, Counsel. Click here for original article

Read Less-

Contributed by: Rahul Yadav, Counsel

Disclaimer

This is intended for general information purposes only. The views and opinions expressed in this article are those of the author/authors and does not necessarily reflect the views of the firm.