Insights

Decoding RBI’s variation margin directions

June 9, 2023While efforts of RBI towards development of OTC derivatives market in India is commendable, the issues faced by Indian market participants need continuous assessment and therefore necessary amendments to the Indian framework to align with global principles on VM remains an evolving path.

The Reserve Bank of India (“RBI”) has released the Variation Margin Directions,2022 (“VM Directions”) which recently have come into effect from May 1, 2023.VM Directions are based on global norms recommended by Basel Committee on Banking Supervision (“BCBS”) and the International Organization of Securities Commissions (“IOSCO”). It aims to address the issue of counter party credit risk in OTC derivative contracts by mandating exchange of collateral between parties and contemplating that upon default, the collateral with the non-defaulting party can be used to set-off obligations of the defaulting party.

As the name suggests, Variation Margin (“VM”) is the collateral required to be collected or posted frequently between parties to cover the daily fluctuations in the market value of an OTC derivative contract.

Read More+

“Both cash and non-cash collateral received as VM can be re-hypothecated, re-pledged or re-used as per the terms of the netting agreement signed between the parties”.

Types of contracts covered by VM Directions

All types of OTC derivative contracts which are permitted by the RBI but are not centrally cleared and settled through a central counterparty (i.e. identified foreign exchange derivatives, interest rate derivatives and credit derivatives are within the purview of VM Directions (“Permitted Contracts”). Permitted Contracts must be executed under a single, legally enforceable netting agreement (which is typically the documentation recommended by International Swap and Derivatives Association).

Entities within the scope of VM Directions

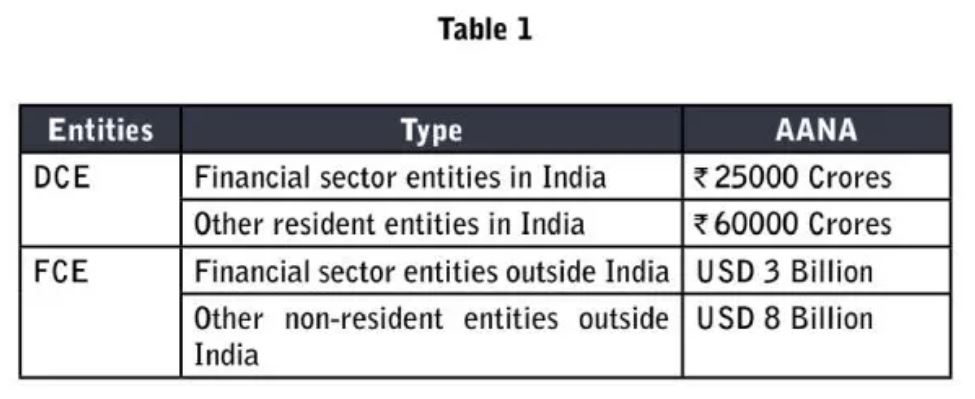

The requirement to collect or post margin under the VM Directions does not apply to all entities who enter into Permitted Contracts. Entities required to comply with the VM Directions are classified into two categories, Domestic Covered Entities (“DCEs”) and Foreign Covered Entities (“FCEs”). DCEs and FCEs are further classified into two categories, entities which are regulated by a financial sector regulator having certain Average Aggregate Notional Amount (“AANA”) and other resident entities having a certain AANA (refer Table1).

Only those entities which meet the above criteria are required to calculate the VM on a daily basis and exchange collateral on an aggregate net basis.

Eligible collateral

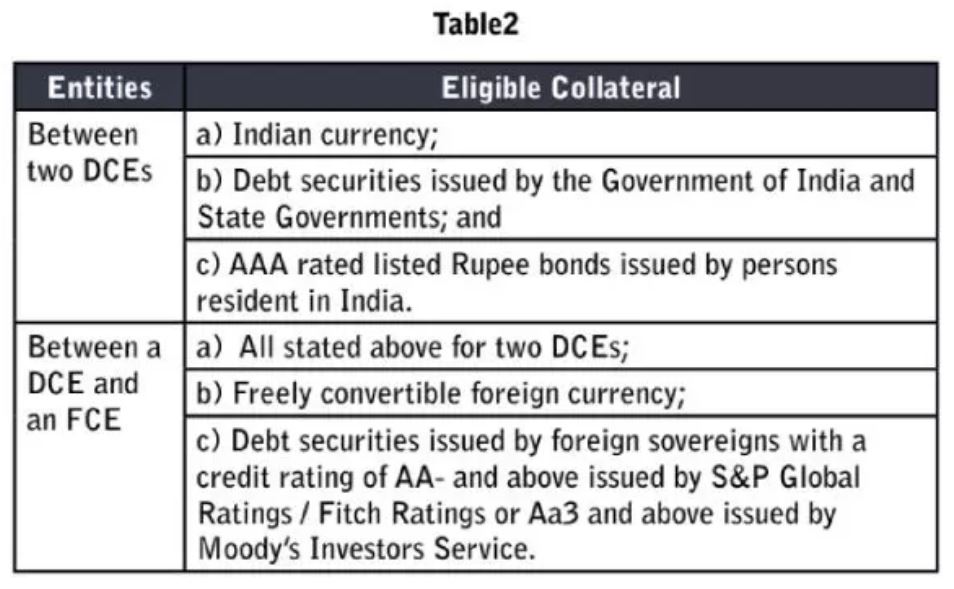

The type of collateral which can be exchanged between the parties is dependent on whether the transaction is between two DCEs or between a DCE and FCE (refer Table 2).

Treatment of collateral

The cash collateral received is not treated as deposits or borrowings. Parties may pay interest on the cash collateral they receive as VM. Also, both cash and non-cash collateral received as VM can be re-hypothecated, re-pledged or re-used as per the terms of the netting agreement signed between the parties.

Key Issues

- Substituted Compliance – The VM Directions allow for substituted compliance if the transaction is entered between a DCE and FCE. Substituted compliance means that the DCE and FCE may comply with either the VM Directions or margin framework of FCE’s jurisdiction, provided that the margin framework of the FCE’s jurisdiction is comparable to VM Directions. To determine comparability, DCE is required to conduct its own assessment based on whether: (a) there is certainty of netting in FCE’s jurisdiction, (b) the FCE is a member of BCBS-IOSCO Working Group on Margin Requirements and, (c) FCEs margining framework is in line with BCBS-IOSCO framework. This assessment must be approved by the board of the DCE and periodically reviewed.

Therefore, it is important that before a DCE starts following the margin framework of a FCE, it conducts a detailed assessment with the help of experts to determine whether the collateral framework of FCE is comparable to VM Directions.

- Posting collateral offshore by foreign bank’s branches in India – Indian branches of foreign banks are classified as DCE under the VM Directions and not allowed to post collateral offshore if the transaction is between a foreign branch of an Indian bank or another foreign bank’s branch in India. Accordingly, foreign bank’s branch in India will have to split its derivative portfolios and collateral agreements with the same counterparty depending on whether the transactions are booked in India or offshore. This creates documentation and operational complexity, especially on account of the fact that the global practice is different.

- Eligible Collateral – Contrary to global standards, VM Directions currently permits limited asset class to be used as collateral (refer Table 2 above). Other type of collateral, such as gold, foreign corporate bonds, equities, units of collective investment schemes and money market instruments have not been permitted by the RBI. This results in competitive disadvantage for Indian market participants.

Additionally, lack of harmonisation between eligible collateral for DCEs and FCEs creates operational inefficiencies, leading to increase in costs, particularly for foreign banks operating in India.

Conclusion

While RBI continues its efforts towards development of the OTC derivatives market in India, it needs to assess the issues faced by market participants and make necessary amendments to align with the global principles on VM. This will not only promote growth of OTC derivative markets in India but also strengthen the market’s risk management framework.

This article was originally published in Legal Era on 9 June 2023 Co-written by: Veena Sivaramakrishnan, Partner; Sumant Prashant, Counsel; Abha Mehta, Senior Associate. Click here for original article

Read Less-

Contributed by: Veena Sivaramakrishnan, Partner; Sumant Prashant, Counsel; Abha Mehta, Senior Associate

Disclaimer

This is intended for general information purposes only. The views and opinions expressed in this article are those of the author/authors and does not necessarily reflect the views of the firm.