Media & Events

Addressing tax challenges of digitalization: Exploring multilateralism as the way ahead for India

September 25, 2021 | New Delhi

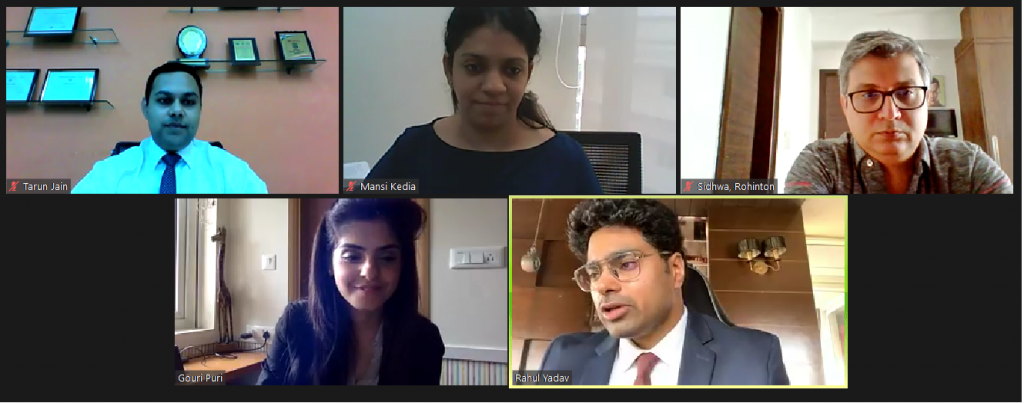

A session on “Addressing tax challenges of digitalization: Exploring multilateralism as the way ahead for India” was held on September 25, 2021. As part of the esteemed panel, our Tax Partner, Gouri Puri was the opening speaker, who laid comprehensive points of discussion and amongst other things highlighted the benefits of a multilateral approach for businesses and its impact on Indian policymaking.

Mr. Kinshuk Jha, Associate Professor and Executive Director Centre for Comparative and International Taxation Jindal Global Law College, introduced the policy paper that was presented to Niti Aayog last week. The paper looks at the different approaches to address the tax challenges of digitalization, namely, OECD’s Pillar One approach, UN’s Article 12B and Digital Services Taxes from an Indian political and economic standpoint.

Moderated by our Principal Associate, Rahul Yadav, the discussion further drew attention to the need for fairer allocation of taxing rights whilst securing a stable international tax regime. The panellists highlighted India’s stand on the OECD’s (The Organisation for Economic Co-operation and Development) inclusive framework, the interface between this international tax debate and India’s international trade relations, tax certainty and investment, and interests of Indian tech companies that are cultivating a global user base.

The panel was graced by the presence and valuable contributions of experts, namely, Mansi Kedia, Fellow Indian Council for Research on International Economic Relations, Rohinton Sidhwa, Partner Deloitte and Tarun jain, Partner BMR Legal Advocate.

Click here to watch the Recorded Session